From zero to CPA in record time: How Kenyth earned two degrees in just 4 months

Discover how a future CPA earned a bachelor's and master's degree in accounting in just over four months through Western Governors University (WGU). This dedicated father balanced work, family, and intense study to achieve 150 CPA credit hours in record time, spending under $10,000 for both degrees. Explore the flexible, competency-based learning model revolutionizing accounting education and career advancement.

How to save your clients millions in property taxes

Discover how accountants can save clients millions by challenging commercial property tax assessments. Learn about the flaws in mass appraisal models and the complex appeal process that creates opportunities for savvy professionals. Explore this untapped service area that could differentiate your practice and provide year-round value to your clients.

How PwC facilitated Evergrande's massive fraud

Chinese regulators have hit PwC China with a six-month suspension and a record 441 million yuan ($62 million) fine for audit failures related to Evergrande. Once a major player in China's property market, Evergrande defaulted and filed for bankruptcy after years of fraudulent activity overlooked by PwC. This case underscores the critical importance of auditor independence and skepticism, highlighting severe consequences when these principles are ignored.

Xero is finally doing traditional bank recs – is QuickBooks in trouble?

Xero unveils game-changing features at Xerocon Nashville, including traditional bank reconciliations, embedded bill pay, and AI capabilities. Learn how these updates stack up against QuickBooks and what they mean for the future of cloud accounting.

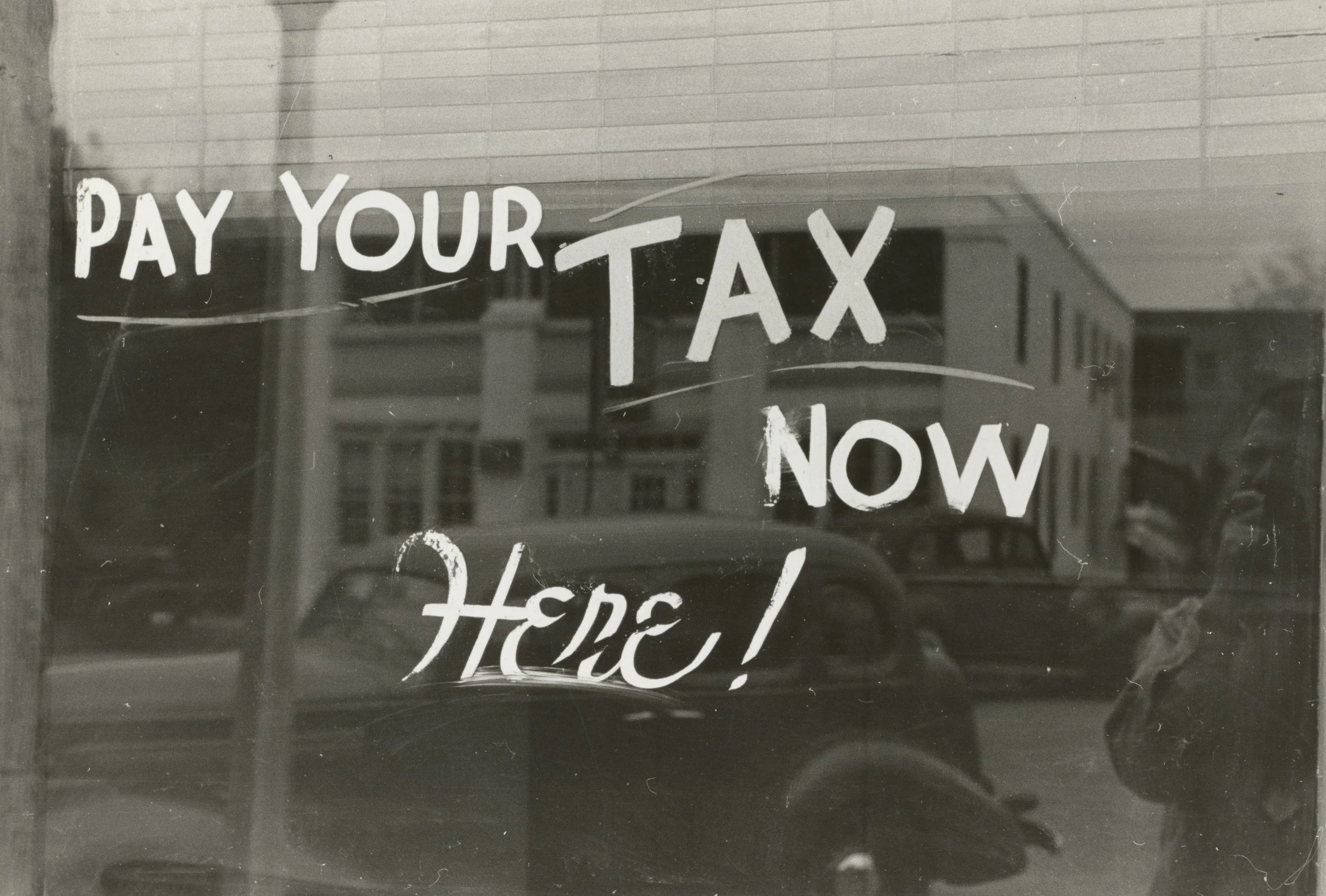

How taxes shape our economy and lives – a conversation with Scott Hodge

In the latest episode of my Earmark Podcast, I sit down with Scott Hodge, president emeritus and senior policy advisor at the Tax Foundation, to discuss his new book, "Taxocracy," and dive deep into how taxes impact our daily lives and the broader economy.

The Savannah Bananas' playbook: Explosive growth strategies for accountants

🍌 What do you get when you mix baseball, circus acts, and shrewd financial strategy? The Savannah Bananas - a team rewriting the business playbook. I recently chatted with Tim Naddy, Savannah Bananas' CFO, about their mind-bending approach to business growth. Now, you can earn free CPE for listening to the interview as part of a free CPE course on Earmark.

Secrets to remote work success from a 100% virtual accounting firm

While some accounting firms pull partners and staff back into the office, others stick with remote work. That’s because they’ve changed how they hire and manage staff. And you can, too.

New course: "How Taxes Shape Our Economy and Lives"

Discover how tax policies shape our economy and daily lives in this new CPE course featuring Scott Hodge, tax policy expert and author. Learn about the impact of taxes on housing, healthcare, and education costs, explore historical tax policies, and understand the economic effects of tariffs. Gain valuable insights to advise clients better and contribute to policy discussions. Earn free NASBA-approved CPE credits by registering for "How Taxes Shape Our Economy and Lives" on Earmark. Perfect for accountants and tax professionals looking to expand their knowledge of tax policy and its real-world implications.

The opportunity for tax pros in the IRS enforcement surge

The IRS tidal wave is here. After years of going easy, they're back to enforcing tax laws with a vengeance. Millions of taxpayers are in their crosshairs, from average folks to wealthy jet-setters. But here's the thing: their offensive is your opportunity.

AICPA's Barry Melancon defends 150-Hour CPA rule

In his farewell tour, outgoing AICPA CEO Barry Melancon is defending the 150-hour rule. He claims the extra year of schooling has "elevated" the profession, creating smarter, savvier CPAs. But has it really?