Stablecoins: The next big thing in accounting (and why it's risky)

The stablecoin market is set to grow by $2 trillion, creating huge opportunities for CPAs. Learn about the risks, rewards, and why accountants are at the center of this revolution.

The $2 trillion stablecoin opportunity for CPAs in the GENIUS Act

The federal government just handed auditors a potential $2 trillion opportunity, but it might also recreate the financial chaos of the 1800s.

Critical CPA licensure changes explained by industry leaders

Join industry leaders representing 70% of U.S. CPAs as they discuss significant changes to CPA licensure requirements, including the elimination of the 150-hour rule. Live webinar March 4 or available on-demand.

How Kenyth got His CPA credits in 3 months and 36 days

A bachelor's degree in 3 months, a master's in 36 days, and all 4 CPA exams passed within 18 months. Kenyth's journey will change everything you know about getting your CPA license. It doesn't have to take nearly as much time or money as you think.

The fight for CPA freedom: NASBA's push for control vs. automatic mobility

Imagine needing approval from a private corporation to drive across state lines. That’s what NASBA and AICPA's proposed changes to the Uniform Accountancy Act could mean for CPAs.

From zero to CPA in record time: How Kenyth earned two degrees in just 4 months

Discover how a future CPA earned a bachelor's and master's degree in accounting in just over four months through Western Governors University (WGU). This dedicated father balanced work, family, and intense study to achieve 150 CPA credit hours in record time, spending under $10,000 for both degrees. Explore the flexible, competency-based learning model revolutionizing accounting education and career advancement.

AICPA's Barry Melancon defends 150-Hour CPA rule

In his farewell tour, outgoing AICPA CEO Barry Melancon is defending the 150-hour rule. He claims the extra year of schooling has "elevated" the profession, creating smarter, savvier CPAs. But has it really?

Want to solve the US accountant shortage? Argentina may have the solution.

Want to solve the US accountant shortage? Argentina may have the solution! I know it sounds crazy, but hear me out...

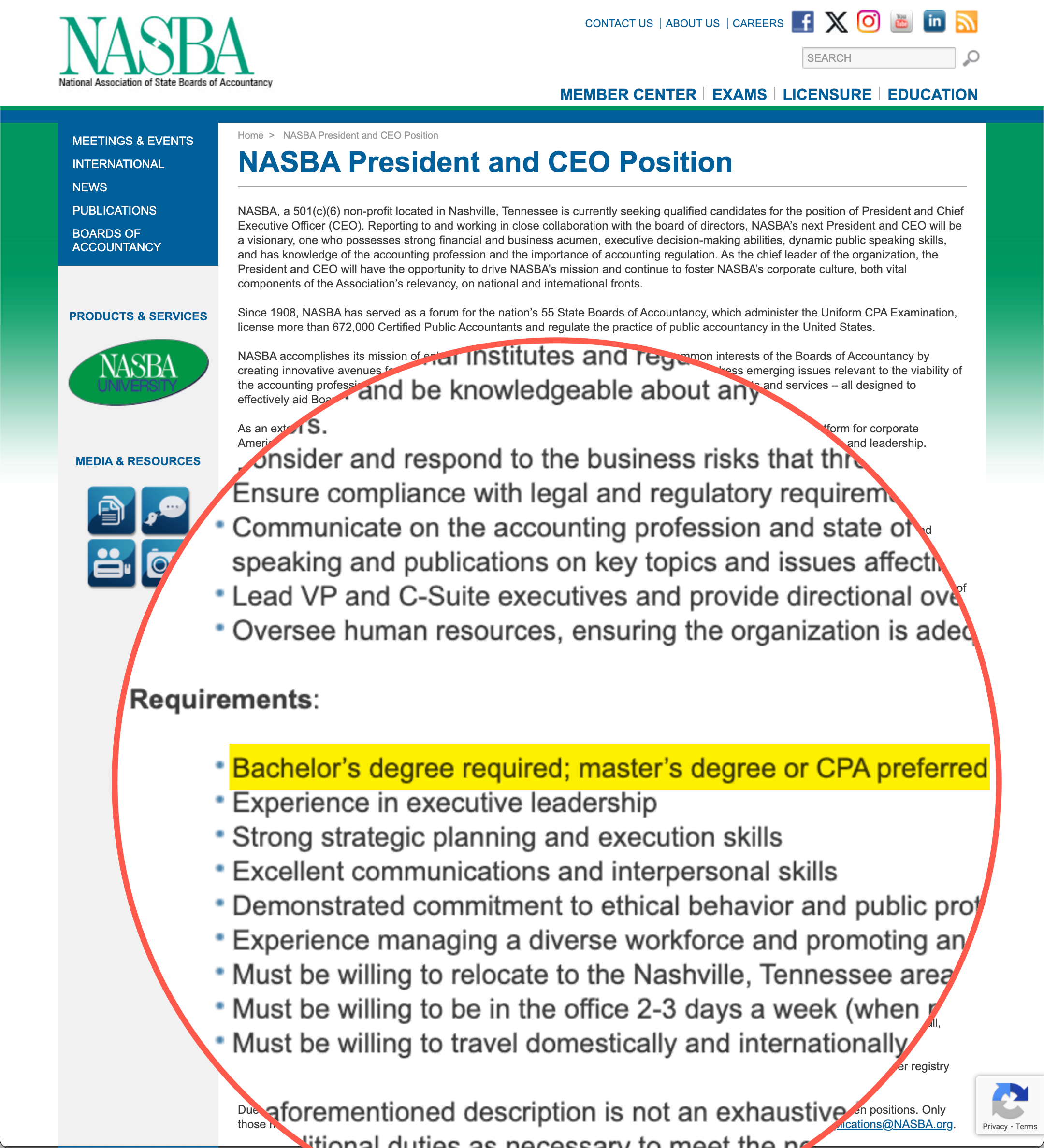

NASBA's President & CEO doesn't need 150 hours or the CPA

The National Association of State Boards of Accountancy (NASBA) seeks a new CEO. According to the job description, this person doesn't need to be a CPA or have five years of higher education.

Could This Be the Fix for the Accounting Talent Shortage?

Earning a CPA license requires 150 credit hours, deterring many students from pursuing accounting. On the Accounting Podcast, Dr. Sharon Lassar of the University of Denver proposes replacing the 150 hours with a “bachelor’s degree + 2 years experience” pathway to the CPA exam. Research shows this would increase candidate volume by 15% without lowering quality by removing an unnecessary time barrier. Lassar makes a compelling case for updating licensing based on facts, addressing concerns around impacts on graduate programs and cross-state mobility. Listen now to understand the 150-hour rule controversy and whether revising requirements could help reverse the talent shortage in the accounting profession.